The Generation Debt Report 2025

- Nearly seven in ten Kiwis (68%) have some form of debt, even higher among Gen Y (77%).

- Half who don’t currently own a home are not even somewhat confident home ownership will be achievable for them.

- Most (84%) Kiwis report that financial stress impacts their mental health.

Managing finances in 2025 can feel like walking a tightrope. With incomes barely scratching the surface of what it takes to keep up with rising living costs, it’s easy to feel like one small slip could tip you into unmanageable debt. As a trusted provider of income protection and life insurance that helps Kiwis protect their financial future, OneChoice wanted to uncover the true impact of debt on everyday New Zealanders. To do so, in partnership with MYMAVINS, OneChoice surveyed over 1,000 New Zealanders aged 18 and above for The Generation Debt Report 2025. The findings reveal that nearly seven in ten (68%) carry some form of debt, with Gen Y being the most affected at 77%. For many, this isn’t just about numbers – it’s about sacrifices, stress, and the struggle to plan for the future.

The burden of debt: How it’s holding us back

Debt has become a reality for so many Kiwis, making it harder to balance what’s needed today with the goals we have for tomorrow. Credit card debt is the most common (42%), followed by mortgages (34%) and personal loans (27%). Gen Y are more likely than other generations to have personal loans (37%) and buy now, pay later (BNPL) schemes (33%). On average, Kiwis carry two types of debt, but 27% manage three or more – rising to 38% among Gen Y, who are the most likely to juggle three or more kinds of debt.

For close to a quarter of those surveyed (23%), the amount of debt being carried feels unmanageable. There’s growing concern about what this means for the future, with over two in five (44% ) worried about passing on debt to their tamariki (children) and more than half (55%) are anxious about carrying debt into retirement. These numbers show how debt isn’t just about money – it’s reshaping priorities and putting big life plans on hold.

When we break it down, the reasons behind our debt are clear. Many suggested wages not keeping up with the high cost of living (32%), while others say it’s due to supporting whānau (family members or dependents) (21%). Large one-time purchases (19%) and overspending (19%) also play a role. Job insecurity adds another layer of difficulty, with nearly one in five (21%) saying they don’t feel secure in their jobs. For those already in debt, the struggle is even greater – close to two in five (37%) say their income isn’t enough to manage repayments, let alone save for the future.

It’s easy to see how this can add up, leaving people feeling stuck. But understanding these challenges is the first step toward solutions. Whether it’s tackling small debts first, seeking financial advice, or focusing on better money habits, there are ways to take control and start building a brighter future.

Tracy Hemingway, Director and Financial Adviser at DebtFreeDiva, shares on how to take actionable steps to tackle debt: "Tackling debt can feel overwhelming, but breaking it into steps makes it manageable. Start by listing all your debts – credit cards, loans, or buy now, pay later balances – along with their interest rates. Focus on paying off high-interest debts first or use the ‘snowball’ method to clear smaller ones for quick wins".

Financial literacy in New Zealand: Are Kiwis in control?

When was the last time you checked your credit score? If you’re like most of us, it might not even be on your radar. While as a majority (88%) we feel at least somewhat confident in our financial literacy, our awareness of credit scores tells a different story. Only about one in five (21%) know their exact credit rating, and nearly half (46%) admitted they have no idea what it is. Without this knowledge, managing debt can become much harder.

This lack of awareness is leading to growing concerns around how we use credit. For example, 32% of credit card holders are highly concerned about accumulating uncontrollable credit card debt, and more than three in five (63%) believe cashless payments increase impulsive spending. Meanwhile, buy now, pay later (BNPL) services are creating new challenges, with around one-fifth finding it difficult to pay off balances on time (18%) or missing payments altogether (22%).

These numbers highlight the importance of financial education, helping us distinguish between 'good' and 'bad' debt, balance credit tools with their risks, and feel empowered to take control of our money for a stable future.

The mental toll of financial stress on young Kiwis

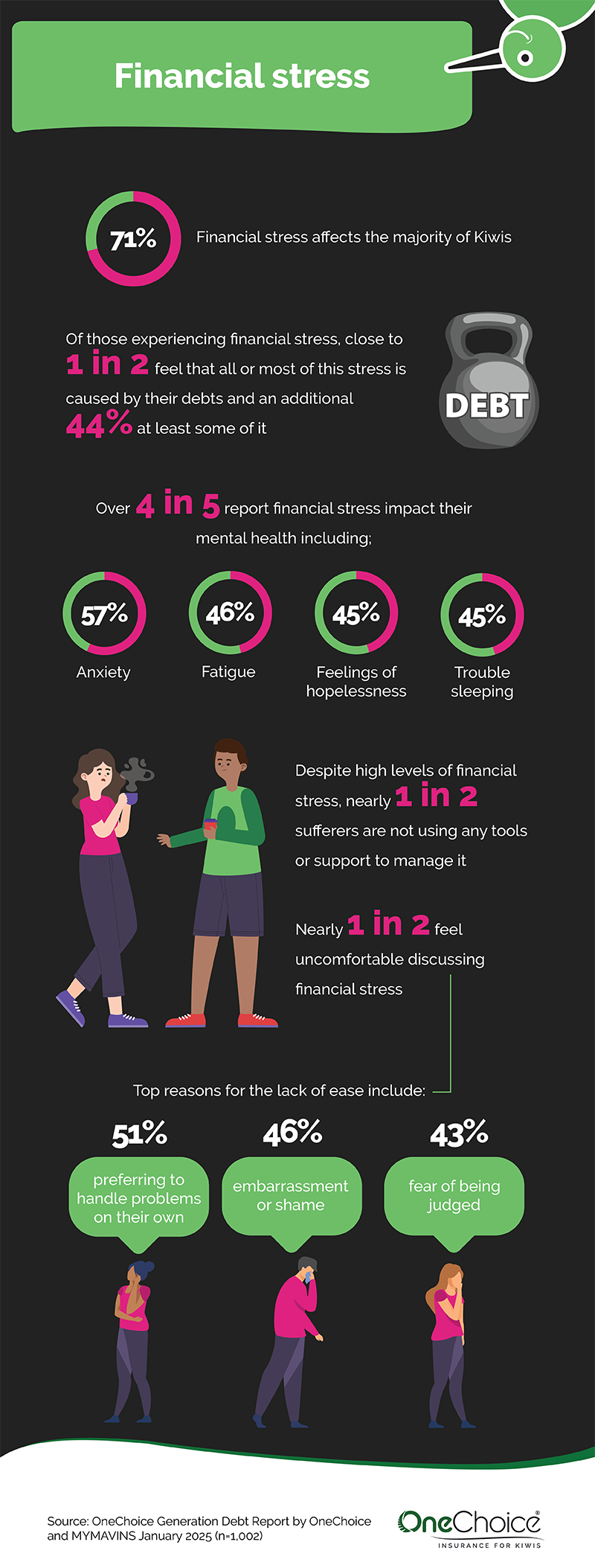

Debt isn’t just about money – it’s affecting how we feel, how we live, and even how we see ourselves. The truth is, financial stress affects the majority (71%) of us, with one in two attributing all or most of this stress to debt. It’s all too common, with over four in five admitting that financial stress is impacting their mental health, leading to anxiety (57%), fatigue (46%), feelings of hopelessness (45%), and trouble sleeping (45%).

What makes it worse is that nearly half of us aren’t reaching out for help. Despite the impact on our wellbeing, almost one in two (46%) don’t use any tools or support to manage financial stress. And when it comes to talking about it, we’re holding back – nearly half (47%) feel uncomfortable discussing financial struggles. Why? Many said they prefer to handle things on their own (51%), feel embarrassed (46%) or fear being judged (43%).

It’s clear that financial stress isn’t just about dollars and cents – it’s reshaping how we think, how we act, and how we connect with others.

FOMO Finances: How Kiwis are balancing fun and financial security

Financial pressures are forcing tough decisions – do we prioritise saving or allow ourselves to live a little? Three-quarters (75%) have cut back on social spending, skipping things like dining out (71%), weekend getaways (57%), and other experiences that bring joy and connection.

Meanwhile, over three-quarters (76%) say they feel torn between ‘living in the now’ and being financially responsible for the future. Over four in five Gen Z (90%) and Millennials (82%) feel more socially isolated and/or missing out on important experiences due to financial constraints in general. This has left many feeling isolated (31%) and frustrated, as financial stress reshapes what can be afforded during what should be some of the most formative years of life.

But it’s not just about today – it’s also about tomorrow. Just over half (55%) are concerned about carrying debt into retirement, and more than two-fifths (44 %) worry about passing debt onto the next generation. Meanwhile, only one in four (26%) feel highly confident they’ll have enough savings to retire comfortably.

We’ve even coined terms like “FOMO finances” to describe the fear of missing out on key life moments due to money worries, from skipping nights out to delaying travel or KiwiSaver contributions. Finding ways to connect meaningfully without overspending, while taking small steps toward financial security, can help balance today’s experiences with a stable future.

How to make good financial decisions for the future

Tracy Hemingway shares: "Managing your finances responsibly doesn’t have to mean drastic changes – it’s about small, smart moves that add up over time. Budgeting isn’t about restriction; it’s about balance. Make room for things you enjoy, like date nights or splurging on fancy ice cream, while still working toward your goals."

"Building an emergency fund is key – start with $500 to $1,000, then aim for 3–6 months of expenses. Once you’ve got that safety net, focus on paying off debt and investing early, even if it’s just through KiwiSaver. Small contributions now can grow significantly over time."

"Finally, keep learning and adjusting. Try to learn one new thing about money each week, whether it’s how mortgages work or tips for boosting your credit score. Financial education is one of the best investments you can make in your future."

As we navigate the cost of living together and work towards building our financial literacy to manage debt, let’s keep the conversation going. Download the full Generation Debt Report 2025 to explore expert insights and strategies for managing debt in New Zealand, or take our quiz to see how your debt compares against other Kiwis.

4 Apr 2025